Zimbabwe's poultry industry has shown massive growth since 2009. A range of sizes of units have sprung up everywhere – from the medium size units of 1000 birds to massive industrial scale operations. Chickens are big business.

Meat consumption has changed significantly in Zimbabwe over the last 20 years. Beef used to be the most consumed, with Zimbabweans eating on average 13kg per annum in the 1980s. According to a recent USAID report (see below), today this has dropped to only 3.3kg, the lowest in the region. Chicken and pork in particular have replaced this, with chicken consumption is now half of all meat consumed. Beef has dropped to only 35%. Meat consumption has rebounded since 2009 as the economy has improved, now estimated to be 11000MT per month, up by 20%. But the pattern of consumption has changed. This has been driven in part by taste, but also austerity as people looked to cheaper sources of protein. According to the USAID report, the retail price of economy beef which has the highest demand is between US$4.60 – US$5.00 per kg compared to the average chicken retail price of about US$3.30 per kg.

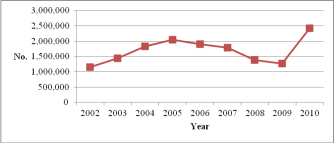

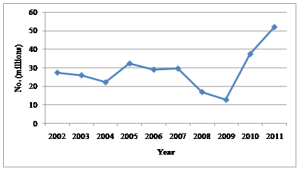

After the stabilization of the economy, many invested in poultry as a sure-fire way of making money. The data in the graphs below are from a recent World Bank report, showing the rapid increase in both broilers and layer production of day old chicks, according to Ministry of Agriculture (MAMID) data.

Day old chick production (layers)

Day old chick production (broilers)

But there are significant challenges to these new producers. These centre in particular on competition from cheap imports, including illegal dumping. ZIMSTATS shows that in 2011 chicken imports were 25,500 MT at a value of $13.644 million or an average of only $0.53/kg. The low price suggests much of this is offal (including 'waste' pieces), which is illegal to import. Additionally the volume exceeds the official quota by over 100%, representing 20% of the total demand for chicken nationally, according to a recent USAID report (see reference below).

In addition the costs of feed have escalated. Soya production has been slow to rebound in Zimbabwe, and imports are costly as only Zambia produced GM-free soya in the region. These imports are expensive as Zambia tries to protect its own growing poultry industry. This really took off when Zimbabwe was suffering outbreaks of avian influenza in the early 2000s, and then subsequently when the Zimbabwe economy collapsed, and along with it its poultry industry.

The 2013 budget statement laid out the challenges for the Zimbabwean industry clearly:

• Stiff competition from cheap imports for both table eggs and meat, threatening viability of producers;

• Rising input costs, particularly maize and soya meal, following poor harvests; and

• High volumes of illegal imports which are being sold in the domestic market at sub-economic prices

The USAID study highlighted the challenge of cheap and illegal poultry imports for the meat industry as a whole. Much of the imported poultry meat comes from Brazil which has a massive poultry industry. Products that cannot be sold in the Brazilian markets are often transported elsewhere in the world. Feet, skin, necks and other 'offal' are frozen and packaged and sold at rock bottom prices.

Chicken pieces too are packaged and sold, again at highly competitive rates. Go to any Zimbabwean supermarket and you will find 1kg of chicken pieces being sold at $3, sometimes considerably less.

How these prices can be so low is beyond me. Maintaining a cold chain from Brazil to Zimbabwe must cost a fortune, let alone the cost of the product and its processing and packaging. While there are import quotas, many believe these are being exceeded through illegal imports. The import of offal is also illegal due to health and safety concerns. The USAID study recommended tighter import controls and the banning of offal imports, arguing that cheap imports were not only damaging the poultry industry, but also the beef industry as cheap meat alternatives were suppressing demand.

This is not just a Zimbabwean problem. In 2012, the South African government slapped on surcharges, provoking a row with the Brazil. Brazil responded by taking the dispute to the WTO, claiming that the South African's protectionist actions were threatening the new friendship developed between the nations as a result of the BRICS partnership. It seems the diplomatic heat, and the threat of a WTO case that the South Africans have backed down, at least for now.

Undeterred by this dispute from across the border, Zimbabwe has now responded to the same problem. The 2013 budget statement noted:

"Due to unfair competition from imports of chicken, local breeders are increasingly cancelling orders for day old chicks as they fail to secure customers for their chicken as imports from outside the SADC/COMESA region retail at prices significantly lower than locally produced chicken, notwithstanding the 40% duty levied on imported chicken…. Investigations indicate that chicken imports are either smuggled or are grossly undervalued for duty purposes. In instances of smuggling, the necessary veterinary and health hazard permit controls are undermined….".

From mid-November, the government introduced a higher customs duty "in order to level the playing field between imported and locally produced chicken".

This is an important and welcome move. Let's see if it has the effect it needs to. Hopefully the Brazilians will be less heavy-handed with Zimbabwe where the market is much smaller, and a trade dispute can be avoided.

Unfortunately, the issue is not just about formal trade. As already noted it is perhaps the illegal trade which is most significant, and damaging. This is well embedded in local Zimbabwean business networks, sometimes with high-level connections, and veterinary control and customs enforcement capacity remains weak. While chicken smuggling is perhaps less dramatic than drugs or diamonds, it has just as devastating an effect on the economy, lives and livelihoods.

Sukume, C. and Maleni, D. (2012). Beef CIBER Study. Constraints to Competitiveness. Unpublished report to the Zimbabwe Agricultural Competitiveness Program, DAI/USAID

This post was written by Ian Scoones and originally appeared on Zimbabweland