Minister of Finance Tendai Biti recently presented the 2013 budget. It was, in his words, the most difficult yet. He revised growth projections downwards to only 4.4%, because of continued depression in the global economy and uncertainty about Zimbabwe's economic and political prospects.

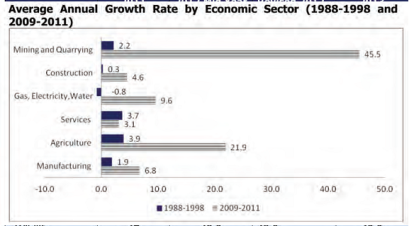

But there were some bright spots. The minister has presided over a remarkable period of recovery. Some basic graphs in his budget statement illustrate the point (copied below). Zimbabwe has grown faster than any other country in the region, and mining and agriculture have been the greatest contributors to growth. By 2010 mining contributed a massive 18% to overall economic output as measured by formal GDP indicators, and nearly 50% of export revenue.

Growth in agriculture was stronger than expected in 2012, as both tobacco and cotton performed better than projections. Maize was however heavily affected by drought. The treasury expects a continued pattern of growth in the sector, around 5-6%.

But the success of agriculture has been overshadowed by the growth of mining, with annual growth rates of around 30%. Exports increased by a massive 230% in the period from 2009-2011. By the end of 2011, mineral exports accounted for 47% of total exports, made up of platinum (43%), gold (28%), and diamonds (20%) in particular. Furthermore, the average share of mining to GDP has grown from an average of 10.2% in the 1990s to an average of 16.9% from 2009–2011 overtaking agriculture. Diamond output is expected to increase to 16.9 million carats in 2013, largely driven by enhanced production from the major diamond mining houses at Marange Diamond Fields. Platinum output is expected to rebound to 11.5 tons in 2013.

However, while growth has occurred at impressive levels since dollarization in 2009, it has not continued at such rates. Zimbabwe's seemingly miraculous recovery from the dire doldrums of the late 2000s may have stalled, a concern raised in the budget. With continued investment uncertainty, and the prospects of yet more disruption during and following elections, question marks are raised about the robustness of the economy. While minerals and agriculture can continue to underpin some growth, the levels required for recovery to earlier levels are still not being achieved.

How can the economy be revived for the longer term? This will require investment, including by the state. The 2013 budget offered US$3.8bn in government expenditure. But this is a pathetically small amount in relation to needs, and much of it already accounted for in terms of salary obligations. Government taxation and revenue collection is improving, but the economic base remains small. Tendai Biti is in a bind. He is right when he says there is no more cash – not even to finance an election, let alone forge a recovery.

Next week, I will look at some future scenarios, making the case for a greater focus on agriculture, and avoiding an overly strong reliance on minerals, despite their allure.

This post was written by Ian Scoones and originally appeared on Zimbabweland